Property investment in Malaysia simply means buying or holding real estate whether a home, shoplot, or industrial unit to generate income or grow wealth over time. For beginners, Malaysia offers a relatively stable and accessible market supported by steady population growth, ongoing urban development, and long-term demand for housing. Despite pockets of oversupply, property remains one of the most reliable asset classes for Malaysians looking to protect their money and build future value.

Understanding property valuation in Malaysia is also essential when assessing long-term investment potential.

Overview of Malaysia’s real estate landscape

Below are the key reasons why many investors continue to favour property as a long-term property investment in Malaysia:

- Hedge against inflation, stable & profitable investment in long-run; if done right.

- Heterogenous investment, unique of asset (unalike in character of each property)

- Potential in capital growth

- Additional Income / Revenue stream (From renting of units)

Malaysia Property Market Trends for Property Investment in Malaysia

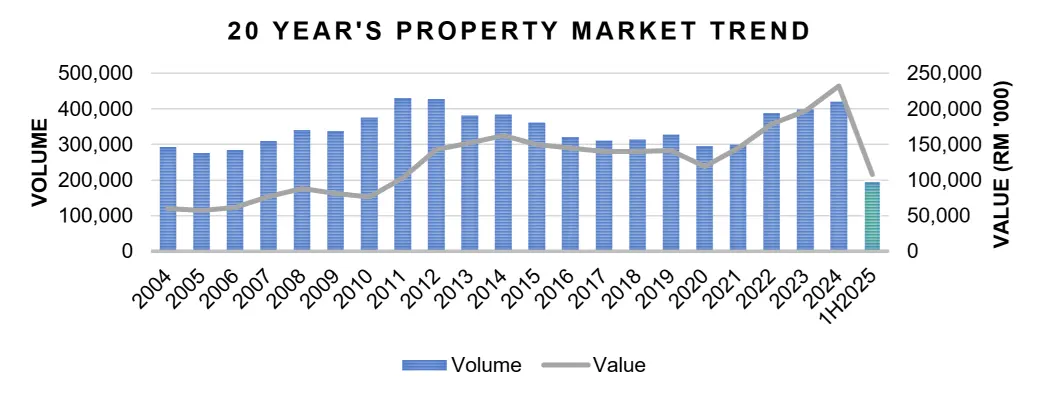

When evaluating property investment in Malaysia, it helps to understand how the market has performed over the past two decades. Despite economic cycles, global shocks, and shifting buyer sentiment, Malaysia’s real estate sector has consistently demonstrated resilience, proving why property remains one of the country’s most dependable long-term investments. Market data shows that transaction volumes and values have moved through clear phases, each shaped by different economic drivers yet all reinforcing property’s role as a stable, growth-focused asset class.

These cyclical movements highlight the importance of relying on professional real estate advisory insights to navigate shifting market conditions.

2004 – 2013: A Decade of Upward Momentum in Malaysia’s Property Investment Market

- Transaction volume ascended steadily, peaking above 400,000 units (2011 – 2012).

- Market believed to be strongly driven by urbanisation, low interest rates, and strong buyer sentiment.

- These conditions made early-period property investment in Malaysia highly attractive for both homeowners and investors.

2014 – 2019: Moderation Period

- Volumes stabilised around 300,000–350,000 units per annum.

- Transaction values remained stable, indicating resilient demand for higher-value properties.

- The market matured, favouring informed, strategy-driven property investment.

2020 – 2021: Pandemic Impacted Property Market

- Noticeable dip in volume and value.

- Market activity constrained due to lockdowns and economic uncertainty.

- However, residential interest remained relatively resilient, showing how property investment in Malaysia continues to serve as a secure asset during uncertainty.

2022 – 2024: A New High for Property Investment Growth in Malaysia

- Sharp rebound driven by pent-up demand and improved economic conditions.

- 2024 recorded the highest value (RM232.3 million) in two decades.

- Investor sentiment strengthened as property regained its status as a long-term hedge and wealth-building platform.

1H2025: Normalised Pullback

- Transaction volume in 1H2025 slipped marginally to 196,232, down from 198,906 in 1H2024

- However, transaction value remains relatively strong, indicating sustained demand.

- Property continues to be a stable asset with strong fundamentals over 20 years.

Why This Matters for Property Investors

These long-term patterns highlight several key insights for anyone exploring property investment in Malaysia:

- The market consistently corrects, stabilises, and rebounds – showing strong fundamentals.

- Demand is driven by structural forces: young demographics, urban expansion, and owner-occupier needs.

- Real estate continues to outperform many traditional savings vehicles in the long run.

Key Considerations Before Starting Property Investment in Malaysia

Before committing to property investment in Malaysia, it is important to understand the fundamentals that influence long-term success. Property can be one of the most rewarding ways to grow wealth — but only when the investment aligns with your goals, financial readiness, and risk profile. Below are the essential factors to consider before buying your first investment property.

Purpose of Investment in Real Estate in Malaysia

Being clear on your objective helps you choose the right property type, location, and financing structure.

- Rental Income (New Income Source)

Ideal for investors seeking steady cash flow. High-demand rental areas or strategically located units can generate consistent passive income. - Capital Appreciation (Wealth Growth)

Suitable for long-term investors aiming to profit from rising property values. Locations with infrastructure growth, new highways, or upcoming commercial hubs typically offer better appreciation. - Retirement Planning

Many Malaysians use property investment as part of a retirement strategy — either to live in comfortably or to hold as an appreciating asset.

Upfront Costs for Property Investment in Malaysia

Property investment is not just about the purchase price. Every buyer should be aware of the upfront costs involved:

- Downpayment

Typically 10% of the purchase price, payable upon signing the Sale & Purchase Agreement (SPA). - SPA Legal Fee

Covers the drafting and execution of the Sale & Purchase Agreement. - Loan Agreement Legal Fee

Required if you’re financing through a bank. - Stamp Duty

This includes stamp duty on transfer and on the loan agreement, payable to the government. - Valuation Fee

For bank financing, valuers assess the property’s market value as a standard requirement for most mortgage applications.

Understanding these costs upfront helps avoid surprises and ensures your property investment in Malaysia fits comfortably within your financial capacity.

Legal Considerations Every Investor Should Know

Malaysia’s property market offers various ownership structures, each with its own implications:

- Freehold vs Leasehold

Freehold gives indefinite ownership; leasehold typically lasts 30–99 years and may require renewal premiums. - Strata Title vs Individual Title

Strata properties involve shared common areas (condos, townhouses), while individual titles apply to standalone units like landed homes. For strata properties, it’s important to understand your rights and responsibilities under strata management regulations. - HDA vs Non-HDA Properties

Properties governed by the Housing Development Act (HDA) provide stronger buyer protections, especially for under-construction units. Non-HDA properties (e.g., commercial units) follow different rules.

Buyers should review the official Housing Development Act (HDA) guidelines to understand the protections available for under-construction homes. - Tenancy Agreement (Landlord vs Tenant Responsibilities)

Clear agreements help prevent disputes on deposits, repairs, duration, and rent increases.

A strong legal foundation protects you from future complications and strengthens the security of your investment.

Understanding Risk and Profit in Property Investment in Malaysia

Like any investment, property comes with potential risks and rewards.

Risks

Investors should also familiarise themselves with Bank Negara Malaysia’s consumer housing finance guidelines to avoid overleveraging.

- Vacancies or late rental payments

- Market oversupply

- High maintenance or renovation costs

- Economic downturns impacting demand

Profit Potential

- Long-term price appreciation

- Consistent rental income

- Ability to leverage borrowed capital

- Tax-deductible expenses (e.g., loan interest)

Successful property investment in Malaysia requires balancing these factors while building a realistic, long-term strategy.

Financing Your Investment: How to Secure Loans for Property Investment in Malaysia

A strong financial profile not only increases approval chances but can also improve loan terms.

Debt Service Ratio (DSR)

Banks use DSR to measure your monthly debt commitments against your income. A lower DSR means a higher probability of approval.

Credit Score

A good credit score shows financial reliability and may lead to better interest rates.

Choosing the Right Loan Packages

- Conventional Loans – Standard interest-based financing.

- Islamic Loans – Shariah-compliant profit-sharing structures (e.g., Bai Bithaman Ajil, Musharakah Mutanaqisah).

- Flexi Loans – Allow extra payments to reduce interest and shorten tenure. Ideal for investors expecting variable cash flow.

Planning your financing early ensures your property purchase remains affordable and aligned with your investment goals.