The build-then-sell (BTS) housing model — where developers complete construction before marketing or selling units — has reappeared at the centre of Malaysia’s housing debate after proposals in the recently tabled 13th Malaysia Plan.

Proponents say build-then-sell protects buyers and reduces abandoned projects; critics warn it could raise development costs and limit supply.

This article explains what build-then-sell means for Malaysia, highlights the data behind the discussion, and sets out Raine & Horne’s view on a balanced way forward.

What is build-then-sell (BTS)?

Under the build-then-sell approach, developers finance and complete construction before transferring ownership to purchasers. This contrasts with the conventional sell-then-build (STB) model in Malaysia, where early-stage pre-sales and progress payments help fund construction.

BTS is designed to give buyers confidence that projects will be finished before ownership changes hands.

Why BTS is back on the policy table

The 13th Malaysia Plan recently signalled stronger policy attention on housing delivery and quality. Among the measures proposed is a possible amendment to the Housing Development Act to encourage — and in some reports, mandate — the build-then-sell model as part of steps to curb abandoned projects and unsold stock.

There are real reasons for urgency. The government’s Task Force on Sick and Abandoned Private Housing Projects (TFST) reported hundreds of delayed, sick and abandoned projects that together represent significant gross development value — a reminder that project failures carry real social and financial costs.

In early 2025, the TFST identified and monitored 230 delayed projects, 347 sick projects and 116 abandoned projects.

The argument in favour of BTS — buyer protection and fewer abandonments

Advocates of build-then-sell say the model reduces the risk of buyers losing deposits or waiting years for keys when projects stall.

Completing projects before sales boosts transparency, builds consumer confidence, and, in theory, strengthens the sector’s overall credibility. This is the key public-interest rationale behind the policy discussion in the 13MP.

Risks of mandating build-then-sell: what industry observers warn

While buyer protection is important, mandating build-then-sell across the board may bring significant unintended consequences:

- Higher financing costs for developers — Without progressive buyer financing, developers must fund construction upfront or take on larger borrowings. That increases financing costs and is likely to be passed on through higher selling prices. Industry analysts have warned of increased financial strain and earnings volatility under mandatory BTS.

- Greater development risk borne by developers — Developers carry the full development risk until sales occur, which can force more conservative pricing or risk-adjusted margins to preserve viability.

- Fewer new launches and lower supply — Smaller or mid-sized developers may not have the balance sheet to adopt BTS, reducing the number of new projects and competition, a potential driver of higher prices. Analysts and broker reports note that BTS could concentrate supply among larger, capital-strong firms.

- Market concentration and price setting — If only a handful of large developers can adopt BTS at scale, competitive pressure may fall, and price discovery could be affected.

These trade-offs suggest that while build-then-sell can help address specific failures, a blanket switch without mitigations could hurt affordability.

The broader data picture: overhang and recovery trends

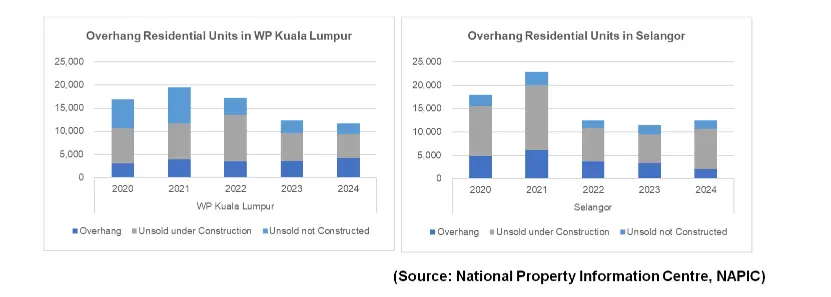

It is important to view BTS in context. Malaysia’s residential overhang (completed but unsold units) has been gradually improving in recent reporting, suggesting some market rebalancing in parts of the country — but structural pockets of unsold inventory remain, especially in certain states and segments. National and industry data show overhang numbers declining year-on-year, but still material in value and volume.

Separately, TFST recovery efforts have managed to revive a number of sick projects, demonstrating that enforcement, targeted interventions and recovery mechanisms can work alongside market mechanisms to resolve problem developments. In early 2025, the TFST reported progress in reviving projects, underscoring the role of active monitoring and remediation.

Raine & Horne’s view: a balanced, evidence-based approach

Raine & Horne supports measures that protect buyers and strengthen market confidence, but we caution against one-size-fits-all mandates for build-then-sell. A more balanced approach would include:

- Targeted adoption: Encourage BTS for specific high-risk segments (e.g., large, speculative high-rise launches or projects with weak pre-sales history) rather than a blanket rule.

- Stronger feasibility & market studies: Require independent market and feasibility studies during approvals, so developers can better match product to demand and pricing. This reduces the likelihood of mispriced projects and project failures.

- Enhanced monitoring and enforcement: Strengthen regulatory oversight, project reporting and faster remedial action via the TFST or similar bodies. Evidence shows active recovery and enforcement can revive projects and return units to the market.

- Financing support and transitional measures: If BTS is encouraged, consider financing facilities, risk-sharing mechanisms (for example, 10:90 or similar hybrid models) and phased implementation to avoid sudden market shocks. Some policy proposals discussed alongside RMK13 reference risk-sharing BTS variants for this reason.

Conclusion — BTS is a tool, not a panacea

The build-then-sell model brings clear buyer-protection benefits, but it is not a universal cure for oversupply, abandoned projects or affordability challenges. Policymakers should weigh the trade-offs carefully. At Raine & Horne, we advocate for a pragmatic, data-driven approach: use BTS where it reduces demonstrable risk, strengthen market assessment and enforcement, and provide support measures so housing remains affordable and supply healthy.

If you’re a developer, investor or buyer and want a data-led assessment of how BTS may affect a project or portfolio — from feasibility and valuation to market positioning — Raine & Horne can help with independent market studies, valuation, and project advisory tailored to Malaysian market realities.